The other day I got here throughout a social media web site and observed an old publish. Of course, this method solely works for companies that can access ample market knowledge on their opponents. On this manner, the market value method is a particularly challenging approach for sole proprietors, as an illustration, as a result of it’s troublesome to search out comparative knowledge on the sale of comparable companies (as sole proprietorships are individually owned). So, this is my chart of estimated enterprise valuations for all privately owned U.S. companies.

The other day I got here throughout a social media web site and observed an old publish. Of course, this method solely works for companies that can access ample market knowledge on their opponents. On this manner, the market value method is a particularly challenging approach for sole proprietors, as an illustration, as a result of it’s troublesome to search out comparative knowledge on the sale of comparable companies (as sole proprietorships are individually owned). So, this is my chart of estimated enterprise valuations for all privately owned U.S. companies.

The book worth approach could also be notably helpful if your online business has low profits, but useful assets. Capitalisation of Earnings Methodology- A method inside the revenue approach whereby economic benefits for a representative single interval are transformed to value by division by a capitalisation rate. There are two steps in the Multiple of Discretionary Earnings technique. Step one is to calculate the enterprise’ discretionary earnings for the subsequent several years. You may take your most up-to-date earnings and estimate what’s likely to occur going ahead or you can common your final several years and use that figure.

Cash Circulate- Cash that is generated over a time period by an asset, group of property, or enterprise enterprise. It could be used in a general sense to encompass varied ranges of particularly defined money flows. When the term is used, it ought to be supplemented by a qualifier (for example, “discretionary” or “working) and a particular definition within the given valuation context. Liquidation Worth. To determine the liquidation value, you first establish the current liquidation market prices for all enterprise assets, except these that can’t be offered (e.g., special tools, or different assets with no market). From that the outstanding liabilities (mortgages, and so on.) are deducted, leading to a business value if operations were ceased instantly.

Businesses are valued for a unique of reasons. For traders, they are valued to see if they can be purchased cheaper than they are at the moment trading. They are hoping to make comparatively small returns whereas preserving risks to a minimum. Valuing a business is more of an art than a science. Every business tends to be distinctive, but there are a selection of common valuation methodologies which can be used and generally weighed towards one another.

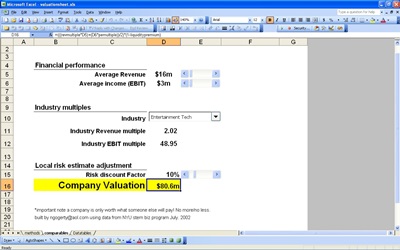

In short, this is an revenue-valuation strategy that lets us know the value of a company by analyzing the annual charge of return, the current money flow and the expected worth of the enterprise. At the most basic degree, enterprise valuation is the method by which the economic price of an organization is determined. Cross-examine methods used to check with the primary valuation method. The assumption is in case you are a buyer on the lookout for a selected sort of business you’ll analysis what individuals are paying for similar businesses. Alternatively, if you’re a seller of a selected kind of enterprise, you will investigate what house owners are accepting for related companies.